Dispelling Medical Device Reimbursement Myths

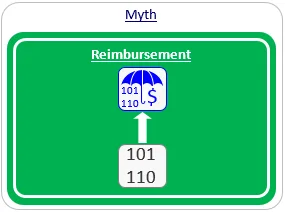

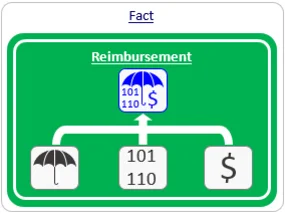

Myth #1: Code = Reimbursement.

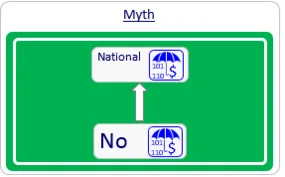

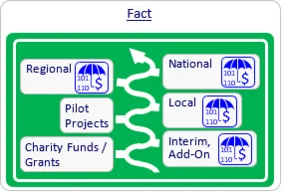

Myth #2: There is either full reimbursement or no reimbursement.

Once it has established an initial user base and real-life evidence, the company may next seek interim, add-on reimbursement by utilizing specific mechanisms in each country (e.g., Innovation Fund or the NUB mechanism in Germany, LPPR add-on List in France or New Technology add-on payments in the US).

At the same time, the company may approach local payers in an attempt to collaborate by conducting a pilot project, which tests the utilization of the new device for a limited time period. At the end of this period, conclusions regarding the reimbursement of the device on a local, regional or national level may be made.

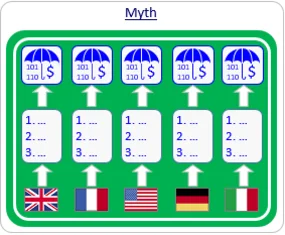

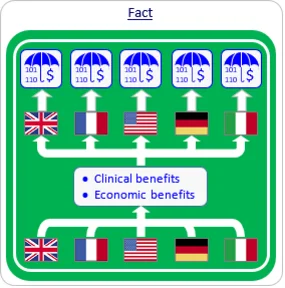

Myth #3: Reimbursement decision-makers in each country use different criteria.

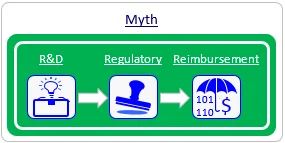

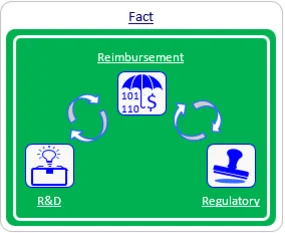

Myth #4: Reimbursement should be dealt with just prior to product launch.

Real Life Examples

Impact on R&D activities

- Example #1: One of our clients developed a 4-sensor product that competed with other available 6-sensor products. This product was clinically superior and less expensive than its competitors. The company invited Mediclever to check whether it could utilize existing reimbursement mechanisms in France. A short assessment revealed available codes, a positive coverage policy, and payment rates that exceeded the company's expectations. However, the wording in the identified existing codes specifically indicated 6 sensors. Both possible alternatives - redesigning the product or developing new reimbursement mechanisms to suit the 4-sensor product - were too expensive at that stage. The company was left out of the French market.

- Example #2: A client in the field of chronic wound treatment developed and launched a product in the US market. Unfortunately, the pressure settings employed by its product deviated from the allowable range specified under existing reimbursement mechanisms. The CEO asked Mediclever to provide the company with a 'reimbursable' specification, and the company was compelled to redesign its product according to this specification.

Impact on regulatory activities

- Example #1: A company that had developed a diagnostic device asked Mediclever to start working on its reimbursement strategy after applying for, and receiving, regulatory clearance. Unfortunately, the wording that was used in the regulatory application substantially decreased the likelihood of reimbursement. On Mediclever's advice, the company re-applied for regulatory clearance with a modified indication for use. This delayed the launch of the product, resulting in substantial loss to the company.

- Example #2: One of our clients developed outstanding clinical data for its product and invited Mediclever to help it develop specific reimbursement mechanisms. Most of the payers that we approached were impressed by the developed clinical evidence, but wanted the company to also present data regarding some economic aspects. Because these economic aspects had not been observed during the company's previous clinical trial, the company had to perform a new trial to gather the requested data. Had the company thought about its reimbursement strategy prior to initiating the clinical trials, those economic aspects could have been integrated into its previous trials, making the investment in a new trial, and the delay in the sale of its product, unnecessary.

Summary

Frequently Asked Questions About Reimbursement Myths

Does a reimbursement code guarantee payment?

No. Reimbursement requires three pillars: a code, a coverage policy, and an established payment rate. A code without coverage results in no payment.

When should I start planning for medical device reimbursement?

Reimbursement strategy should be integrated early in the R&D and regulatory phases to avoid costly product redesigns or clinical trial gaps.

Are reimbursement criteria different in every country?

While procedural details vary, 99% of payers worldwide focus on two main criteria: significant clinical benefit over alternatives and economic benefit to the medical pathway.