The Problem with Innovative Medical Devices

During the past half century companies have generally heeded Levitt's (1960) advice to avoid "marketing myopia" by focusing on the customer. In the medical device industry this means, designing products with a focus on physicians.

In a Working Paper called "The New Marketing Myopia" (INSEAD, 2009) the authors argue that companies have learned that lesson too well, resulting today in a new form of marketing myopia, which stems from a single-minded focus on the customer to the exclusion of other stakeholders.

In the medical device industry this new marketing myopia occurs when companies that have physicians and regulatory experts as part of their staff or advisory board, develop products without paying attention to an additional important stakeholder - the payor (i.e., health insurance company / health fund / CCG).

Strategic Payer Engagement Strategy: Propositions for Practice

By standing on the shoulders of giants we follow the principles set in "The New Marketing Myopia" and demonstrate how simple activities can help medical device companies correct the myopia.

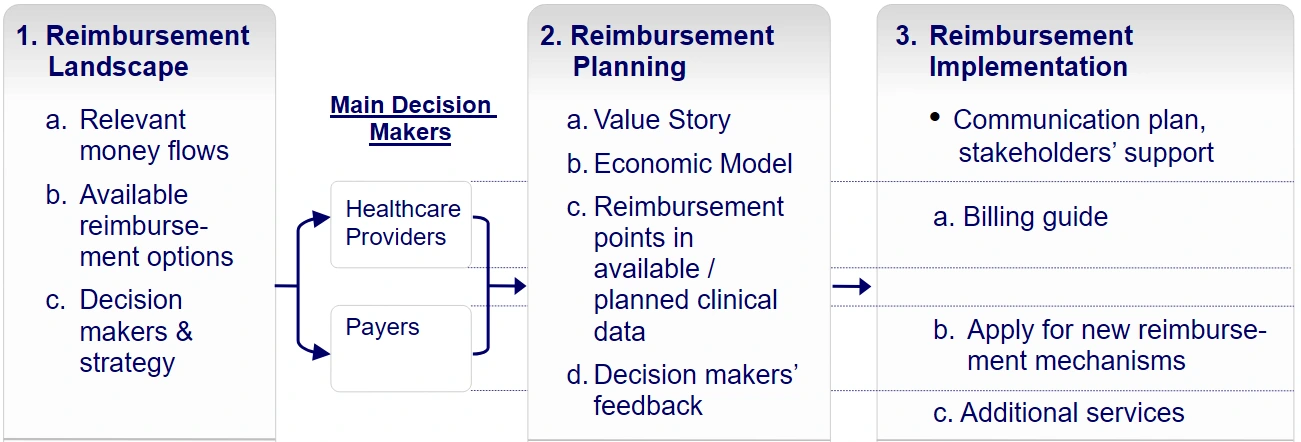

The authors of "The New Marketing Myopia" set five propositions for practice, which we segmented into the following 3 activities:.

1. Map and prioritize the company's stakeholders

In this part, we identify the key MedTech market access stakeholders as part of the 'reimbursement landscape'. During this phase, the company typically raises the following questions:

- Can the company's medical device fit under existing reimbursement mechanisms (appropriate codes, coverage policies and payment rates) or would the company need to develop new mechanisms?

- Understanding whether the company should develop new mechanisms, and which ones, may help the company focus on the relevant stakeholders and align its strategy to achieve a new code, a positive coverage policy or just change a payment rate.

- Are certain payors more important than others?

- For example, are certain payors considered early adopters in the field which is relevant to the company's device? Will the company's device be used to treat older people, requiring a focus on payors that typically cover the elderly? Will the device first be used by patients with private health insurance directing the company towards private payors, rather than statutory/public ones?

- Understanding current reimbursement gaps and the specific payors that should be addressed is the first step towards learning about the requirements of a stakeholder with a major impact on the company's success.

2. Research stakeholder issues and expectations

In this part, which we typically refer to as 'reimbursement planning' the following questions may be raised:

Can we claim that the new device provides payors with both, clinical and economic benefits over currently available alternatives? (Based on previous experience, in most cases, payors would require both).

To answer this question the company should develop a 'value story' for the device, illustrating potential clinical and economic benefits in comparison with currently utilized alternatives.

Based upon the developed 'value story', an economic model is devised, quantifying the economic benefit from the payor's perspective, given the company's anticipated price for the new device.

Can we actually demonstrate those clinical and economic benefits to payors?

In order to verify that existing clinical data or a planned clinical study could be used to derive the 'evidence', required by payors, the company's existing clinical data is reviewed and possible reimbursement-related points are added to any planned clinical study protocol.

In some cases, it is possible to leverage clinical studies that the company conducts anyway, in order to derive reimbursement related data, which will be required later by payors.

3. Engage with stakeholders and embed their orientation

This is actually the last part of the above mentioned 'reimbursement planning' phase, in which the company contacts and coordinates interviews with relevant payor representatives in the local healthcare system. The purpose of these interviews is to obtain payors' feedback regarding the developed value story, the economic model and the reimbursement aspects of existing clinical data or the planned clinical study, prior to initiating clinical studies or applying for new reimbursement mechanisms.

According to payors' feedback the company may wish to make modifications to its value story, market price, a planned clinical study protocol, or proceed to conduct the actual study (if necessary).

| Factor | Physician Perspective | Payer Perspective | May Impact |

|---|---|---|---|

| Primary Goal | Clinical efficacy, patient safety, and ease of use in the OR. | Cost-effectiveness, population health, and long-term ROI. | Adoption Rate Coverage Policy Strategic alignment is key |

| Evidence Need | Peer-reviewed journals and personal experience. | Budget impact models and Real World Evidence (RWE). | Trial Design Data Value Economic data is mandatory |

| The "Win" | Improved patient outcomes and faster recovery times. | Reduction in the total cost of care across a population. | Price Point Reimbursement Rate Win-win evidence required |

Medical Device Reimbursement Process Flowchart

Summary

In our 20+ years of consulting, we’ve seen brilliant technologies fail simply because the clinical trials didn't capture the specific 'economic endpoints' that payers like Cigna or CMS require.

Medical device reimbursement myopia, demonstrated by excluding payors' interests and requirements can have serious adverse consequences for any medical device company. As healthcare systems worldwide are facing fiscal constraints, commercializing medical devices without a proactive payer engagement strategy may lead the company to design products and clinical trials that inhibit reimbursement and could actually leave the device out of the market.

Mediclever can assist by developing an appropriate reimbursement strategy, by guiding you through the development of the required evidence and by leveraging its contacts in North American and European healthcare markets in order to obtain payors' feedback in advance.

Market Access & Payer Engagement FAQ

What is Medical Device Reimbursement Myopia?

It is a strategic error where companies focus on physicians and regulatory approval while ignoring the economic requirements of payers (insurance companies and health funds).

Why is identifying MedTech market access stakeholders critical?

While physicians drive use, payers control the budget. Identifying stakeholders like medical directors and value-based committees early ensures your clinical trials meet their specific evidence needs.

What clinical evidence do major payers like Cigna require for coverage?

Payers like Cigna typically look for three things: evidence in peer-reviewed journals, better clinical results than current standards, and the same or better outcomes at a lower cost.

Navigating the Global Payer Landscape

Reimbursement myopia often occurs when a company assumes the "Payer" is a monolith. In reality, the stakeholders you must engage with vary drastically by geography:

United States (US): The Triad

In the US, success requires aligning Coding (AMA/CMS), Coverage (Medical Directors at Cigna/United), and Payment (Hospital Value-Based Committees). Myopia here is often forgetting that a CPT code doesn't guaranteed a positive coverage policy.

Europe (EU): The HTA Gatekeepers

In the EU, the focus shifts to Health Technology Assessment (HTA) bodies like NICE (UK) or G-BA (Germany). Here, "Economic Evidence" usually means demonstrating a favorable Cost-Utility Ratio or a Quality-Adjusted Life Year (QALY) improvement.